Remittances, Costs and Catastrophes

Abstract

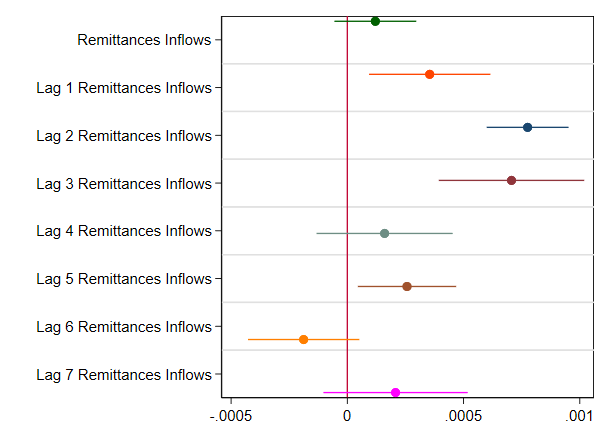

The paper attempts to better understand the mechanisms underlying the costs of remittances. It does so using a multi-country analysis over the 2010s. More specifically, it tries to highlight whether and how the operators on the market adjust to a shock in the demand for remittances. To address endogeneity as well as severe measurement errors, I propose to use the climatic disasters that occurred in the country receiving remittances as an instrument. It appears that, overall, a demand shock on the market of remittances does push up costs up to a delay of a quarter up to a year. Reassuringly, the catastrophe contemporaneously impacts the remittances and so to a large extent, which suggests that further use of this instrument can be achieved in future research.